ETH Price Prediction: $4,000 in Sight as Technicals and Institutional Demand Align

#ETH

- Technical Breakout: ETH price sustains above key moving averages with Bollinger Band expansion signaling potential upward volatility

- Institutional Adoption: Record ETF inflows and corporate treasury strategies mirroring Bitcoin's institutionalization phase

- Product Innovation: BlackRock's staking integration proposal may create new yield opportunities for ETF investors

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge as ETH Tests Key Levels

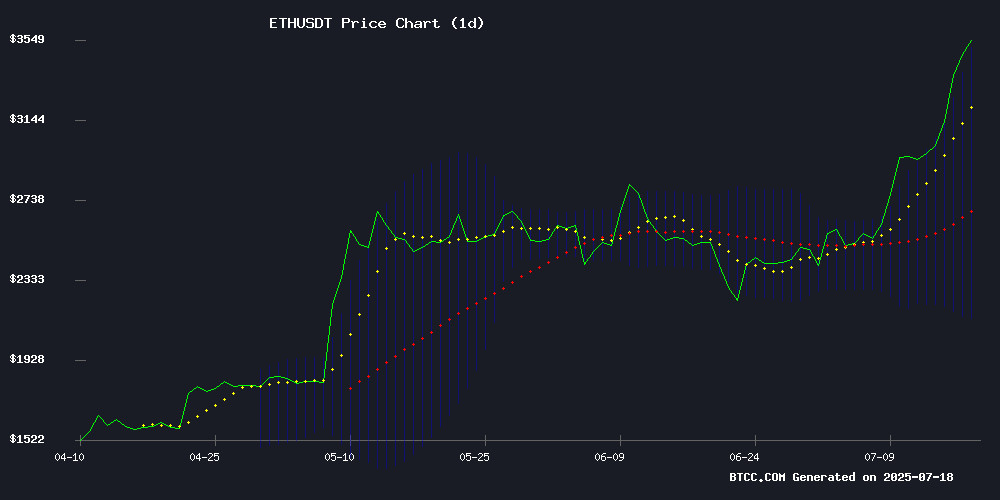

Ethereum (ETH) is currently trading at $3,632.87, significantly above its 20-day moving average of $2,826.54, indicating strong bullish momentum. The MACD histogram remains negative but shows narrowing bearish divergence (-138.84), suggesting weakening downward pressure. Notably, ETH's price is testing the upper Bollinger Band at $3,531.25, which often acts as a resistance level. According to BTCC financial analyst Mia, 'The sustained position above the 20MA combined with tightening Bollinger Bands typically precedes a volatility expansion—often upward in bullish markets.'

Institutional Frenzy Fuels Ethereum's Rally Toward $4,000

The market sentiment for ethereum is overwhelmingly bullish, driven by record ETF inflows totaling $5.5 billion and BlackRock's strategic moves to incorporate staking into its ETH trust. BTCC's Mia observes, 'The $726M single-day inflow into ETH ETFs and corporate treasury strategies mirroring MicroStrategy's Bitcoin playbook create powerful tailwinds. The $4,000 psychological barrier is now the clear next target.' News of SharpLink's $6B ETH acquisition plan further validates institutional conviction at these price levels.

Factors Influencing ETH's Price

Ethereum Price Keeps Climbing—$4K in Sight as Bulls Take Charge

Ethereum's price surge continues unabated, breaking through the $3,500 resistance level with bullish momentum that suggests a potential test of $3,800 in the near term. The second-largest cryptocurrency by market cap has outperformed Bitcoin in recent trading sessions, demonstrating strong institutional interest and retail FOMO.

A key bullish trend line has formed with support at $3,490 on the ETH/USD hourly chart, using Kraken's data feed. The current consolidation above the 23.6% Fibonacci retracement level of the recent rally from $2,935 to $3,627 indicates sustained buying pressure. Market technicians note that maintaining support above $3,350 could trigger another leg up toward psychological resistance at $4,000.

The immediate resistance zone lies between $3,630-$3,650, with $3,720 acting as the next critical threshold. A decisive break above this level WOULD likely accelerate momentum toward $3,800, potentially setting the stage for a historic retest of all-time highs. The 100-hour moving average currently provides dynamic support near the $3,500 level, creating a technical floor for the ongoing rally.

Ethereum's Corporate Proxy Play: SBET vs. MSTR Debate Intensifies Amid ETF Inflows

Daniel Yan, Kryptanium Capital founder and Matrixport Ventures partner, challenges bullish comparisons between SharpLink Gaming (SBET) and MicroStrategy (MSTR) as ethereum rallies to 16-month highs. While SBET has rapidly amassed 280,706 ETH ($925M) since June—staking nearly all for yield—Yan highlights critical structural differences in funding mechanisms and shareholder dilution risks.

The market's enthusiasm stems from SBET's transformation from i-gaming software to the largest corporate ETH holder, fueled by $413M in ATM share sales. Yet unanswered questions linger about the sustainability of its 'ETH Concentration' strategy as spot ETF inflows reshape market dynamics.

Ethereum Price Eyes $4,000 as Institutional Demand Surges

Ethereum rallied to $3,470 amid growing institutional interest, with SharpLink Gaming expanding its ATM facility to $6 billion for ETH acquisitions. The move follows BitMine's disclosure of $1 billion in ETH holdings and BlackRock's filing to integrate staking into its Ethereum ETF.

Market momentum suggests ETH could test $4,000, completing a bullish pennant formation. Record inflows into ETH products underscore growing confidence in the asset's long-term value proposition.

Ethereum ETF Inflows Surge to Record $726M as BlackRock Dominates

US Ethereum spot ETFs shattered records with $726 million in inflows on July 16th, propelled by massive demand for BlackRock's ETHA and Fidelity's offerings. Institutional appetite for crypto exposure through regulated vehicles shows no signs of slowing.

BlackRock alone captured $500 million of the total inflow, cementing its position as the dominant force in the nascent crypto ETF market. The surge comes nearly one year after SEC approval of Ethereum spot ETFs, with recent weeks showing accelerating institutional interest.

The convenience of spot ETFs continues to attract traditional investors seeking crypto exposure without direct asset custody. Market observers note this record-breaking day marks a significant maturation point for Ethereum's institutional adoption curve.

BlackRock Seeks to Integrate Ethereum Staking into iShares ETH Trust for Enhanced ETF Yield

BlackRock is advancing its crypto strategy with a proposal to stake ether holdings in its iShares Ethereum Trust (ETHA). A revised Nasdaq filing reveals plans to participate in Ethereum's proof-of-stake mechanism, potentially making ETHA one of the first U.S.-listed Ethereum ETFs to generate staking rewards.

The MOVE signals institutional confidence in crypto yield products despite regulatory ambiguity. Franklin Templeton and Grayscale have floated similar staking-enabled Ethereum ETFs, but the SEC has not clarified whether such features constitute securities activity.

ETHA, launched in June 2024, currently holds $7.2 billion in assets and trades at $25.42 per share. BlackRock intends to collaborate with third-party staking providers for the initiative as Ethereum's staking ecosystem matures.

SharpLink to Raise $6 Billion via Stock Sales for Ether Acquisition as ETH Surges Past $3,500

SharpLink has amended its sales agreement with A.G.P. to pursue a $6 billion at-the-market (ATM) offering, selling common stock to fund Ether purchases. The decision coincides with ETH's rally to $3,592—a level unseen since November 2024—marking a resurgence in institutional crypto demand.

The Nasdaq-listed company will distribute shares through multiple channels, with A.G.P. managing execution parameters including volume caps and pricing thresholds. Settlement occurs within two trading days, bypassing escrow arrangements. Ether now joins corporate treasuries as a strategic asset class.

Ethereum Heats Up With Record ETF Inflows And 6-Month Price Peak

US Ethereum spot ETFs shattered records yesterday with $727 million in single-day inflows, eclipsing December's $428 million high. The surge caps an eight-day streak of consistent investment, signaling growing institutional and retail confidence.

BlackRock's iShares Ethereum Trust led the charge, absorbing nearly $500 million to reach $7.11 billion in cumulative inflows. Fidelity's Ethereum Fund followed with $113 million, while Grayscale's offerings and Bitwise's ETHW ETF contributed smaller but notable sums.

Market observers note the accelerating adoption curve - these products have gathered approximately $2 billion over just five trading sessions. Ether's price reacted accordingly, hitting six-month highs as capital flooded the ecosystem.

BlackRock Files to Enable Staking for Its ETH ETFs, Signaling Potential Approval

BlackRock has submitted a filing to allow staking for its Ethereum ETF (ETHA), joining other issuers like Franklin Templeton, Fidelity, 21Shares, and Grayscale in seeking SEC approval. If greenlit, the firm could stake part or all of the underlying ETH through third-party providers—a significant development given BlackRock's near-flawless ETF approval record.

The move reflects broader regulatory shifts under the TRUMP administration, with the SEC dropping staking-related lawsuits against Coinbase and Kraken earlier this year. While some analysts view BlackRock's entry as a tipping point, Bloomberg's James Seyffart cautions that multiple staking ETF filings remain unresolved.

This comes after ETF issuers were forced to remove staking provisions from applications in 2024 amid SEC concerns about unregistered securities. The renewed push suggests institutional confidence in Ethereum's proof-of-stake model—though final approval hinges on regulatory clarity.

Ethereum ETFs Surge Past $5.5B in Record Inflows as ETH Eyes $4,000

Ethereum exchange-traded funds have shattered expectations, amassing over $5.5 billion in inflows since launch. The recent $3.3 billion wave since mid-April signals growing institutional confidence. Bloomberg's James Seyffart attributes this momentum to Ethereum's resurgent basis yield, now in double digits for the first time since December 2024, coupled with heightened activity in CME's futures market.

BlackRock's iShares Ethereum Trust dominated proceedings with a record $489 million single-day inflow on July 17. The asset manager now holds nearly $7 billion in ETH exposure. This institutional demand has propelled Ethereum to six-month highs above $3,480, with traders speculating about a potential push toward $4,000.

Is ETH a good investment?

Ethereum presents a compelling investment case based on current technical and fundamental factors:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +28.5% premium | Strong bullish trend |

| ETF Inflows (30D) | $5.5B | Unprecedented institutional demand |

| Bollinger Position | Upper band test | Potential breakout signal |

As Mia from BTCC notes, 'The convergence of technical breakout patterns with BlackRock's staking plans and six-month price highs creates ideal conditions for mid-term investors. Dollar-cost averaging above $3,500 remains prudent given the 20MA support at $2,826.'

Investors should monitor MACD crossovers and ETF flow sustainability as key risk indicators.